Woozle Research Launches New Primary Research Platform That Delivers Finished Intelligence to Investment Professionals

Woozle Research Launches New Primary Research Platform That Delivers Finished Intelligence to Investment Professionals

Platform eliminates expert network middleman tax with performance-based pricing and verified intelligence. Early clients reduce research costs by 50 percent while recovering 14 hours per month of analyst time.

LONDON, UK — Woozle Research announces the launch of its new primary research platform designed to eliminate the middleman tax in expert networks and survey platforms. The company delivers verified, decision-ready intelligence to hedge funds, private equity firms, and institutional investors who need accurate answers without the administrative burden of traditional research models.

Founded by Mark Pacitti, CFA in 2016, a former buyside analyst at Goldman Sachs and Citadel, Woozle Research addresses a structural inefficiency in the primary research market. Traditional expert networks charge approximately $1,200 per call with an estimated 40 percent of conversations producing unusable insights, driving the true cost per useful insight closer to $3,000 when factoring in wasted analyst time and failed calls. Survey platforms present similar challenges, with stacked middleman margins and low-quality panels that require extensive internal cleaning and validation.

"Investment teams are paying research prices for access products," says Pacitti. "They're spending roughly 14 hours per month scheduling calls, vetting experts, conducting interviews, and cleaning survey data. Time gets taken away from investment decisions. We built Woozle's new platform to deliver what investors need: verified answers that go straight into IC memos and investment models."

How the Platform Works

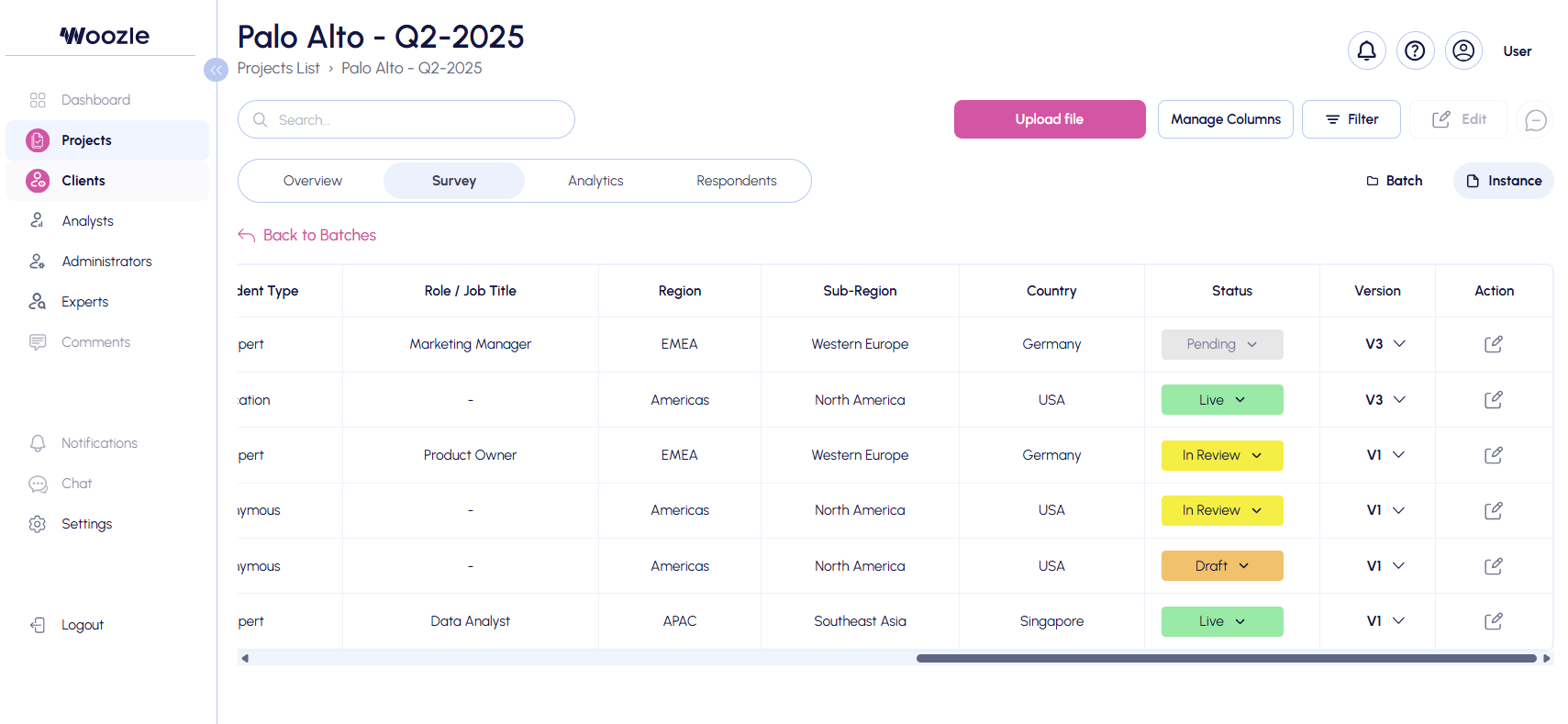

The platform operates on a fundamentally different model than traditional providers. Clients submit a 10-minute brief outlining their investment hypothesis and research questions. Woozle's team then recruits fresh experts specific to each project rather than drawing from recycled databases, conducts structured interviews or surveys, and delivers outputs that have already been ID-verified, cross-referenced, and validated. The company eliminates client involvement in scheduling, interviewing, note-taking, and data cleaning.

Woozle Research implements performance-based pricing that ties fees to outcome quality. Clients pay only for intelligence that genuinely improves their investment decisions, a departure from the volume-based economics that dominate expert networks and survey platforms. This pricing structure aligns provider incentives with investor outcomes rather than call volume or survey completes.

"The primary research infrastructure was built for middlemen, not investors," adds Pacitti. "Expert networks profit from maximizing call volume regardless of utility. Survey platforms stack margins across multiple intermediaries while pushing design, fielding, and analysis back onto the client. We remove those layers entirely and own the full chain from brief to finished intelligence."

Verification and Quality Standards

The verification process includes identity confirmation for all respondents, cross-referencing of key claims, and human validation before delivery. This approach addresses compliance and quality concerns that arise when investment teams conduct their own expert calls or work with unverified survey panels.

Woozle Research serves portfolio managers, analysts, and deal teams at investment firms who run concentrated portfolios and operate under tight diligence timelines. The platform covers both qualitative expert interviews and quantitative survey research across industries and geographies.

The company reports that early clients have reduced their cost per useful insight by approximately 50 percent compared to traditional expert networks while recovering significant analyst time previously spent on research logistics.

Additional Information

What makes Woozle Research different from traditional expert networks?

Woozle delivers finished intelligence instead of access. Clients submit a brief and receive verified, decision-ready outputs. No scheduling, interviewing, or note-taking required. Traditional expert networks connect clients to experts and leave the research work to investment teams.

How does performance-based pricing work?

Clients pay only for intelligence that improves their investment decisions. If outputs don't meet expectations, Woozle won't charge. This aligns incentives with outcomes instead of call volume.

Where do Woozle's experts come from?

Woozle recruits fresh experts for each project based on specific research questions. The company does not use recycled databases or shared expert pools.

What verification does Woozle provide?

All respondents are ID-verified. Key claims are cross-referenced. Outputs undergo human validation before delivery. This reduces compliance risk and eliminates internal fact-checking.

What results are clients seeing?

Early clients reduced their cost per useful insight by approximately 50 percent compared to traditional expert networks. Clients also recover the 14 hours per month analysts typically spend on research logistics.

About Woozle Research

Woozle Research is a primary research platform that delivers finished intelligence to investment professionals. Founded by buyside veterans, the company provides verified expert interviews and survey research designed around how real investment decisions are made. Woozle eliminates the middleman model by recruiting fresh experts for each project, conducting structured research, and delivering decision-ready outputs with performance-based pricing. For more information, visit woozleresearch.com.

Media Contact

Mark Pacitti, CFA

Founder & Managing Director

Woozle Research

Mark.pacitti@woozleresearch.com