31% of Expert Network Consultations Involve Unqualified Participants, Industry-First Survey Reveals

31% of Expert Network Consultations Involve Unqualified Participants, Industry-First Survey Reveals

Nearly one-third of expert network consultations involve participants who weren't actually qualified for the call, according to the first large-scale survey of the professionals who provide expertise to investment firms and corporate clients paying $1,000-1,500 per consultation.

The study of 1,368 expert network participants, released today as "The State of the Expert Economy 2025," exposes systemic quality control failures, widespread dissatisfaction with AI moderation, and a compensation structure where experts receive as little as 15% of what clients pay.

Key findings include:

31% of experts have completed calls they weren't qualified for, raising questions about vetting processes in an industry charging premium rates for specialised knowledge

71% receive project invitations that don't match their expertise, with 32% reporting frequent mismatches

81% of experts who tried AI-moderated consultations found meaningful deficiencies compared to human moderation, including poor follow-up questions and inability to understand context

65% of experts earn less than $400 per call whilst clients pay $1,000-1,500, with the most common pay range just $100-199

82% believe fair compensation should be $500+ per hour, yet only 18% actually earn that amount

"When clients pay $1,200 for a consultation and 31% of experts admit they weren't qualified for the call, that's not a quality control issue — it's a systemic failure," said Mark Pacitti, CFA, Founder of Woozle Research. "Add that 71% of experts receive project invitations that don't match their expertise, and you have an industry charging premium rates for keyword matching, not curation."

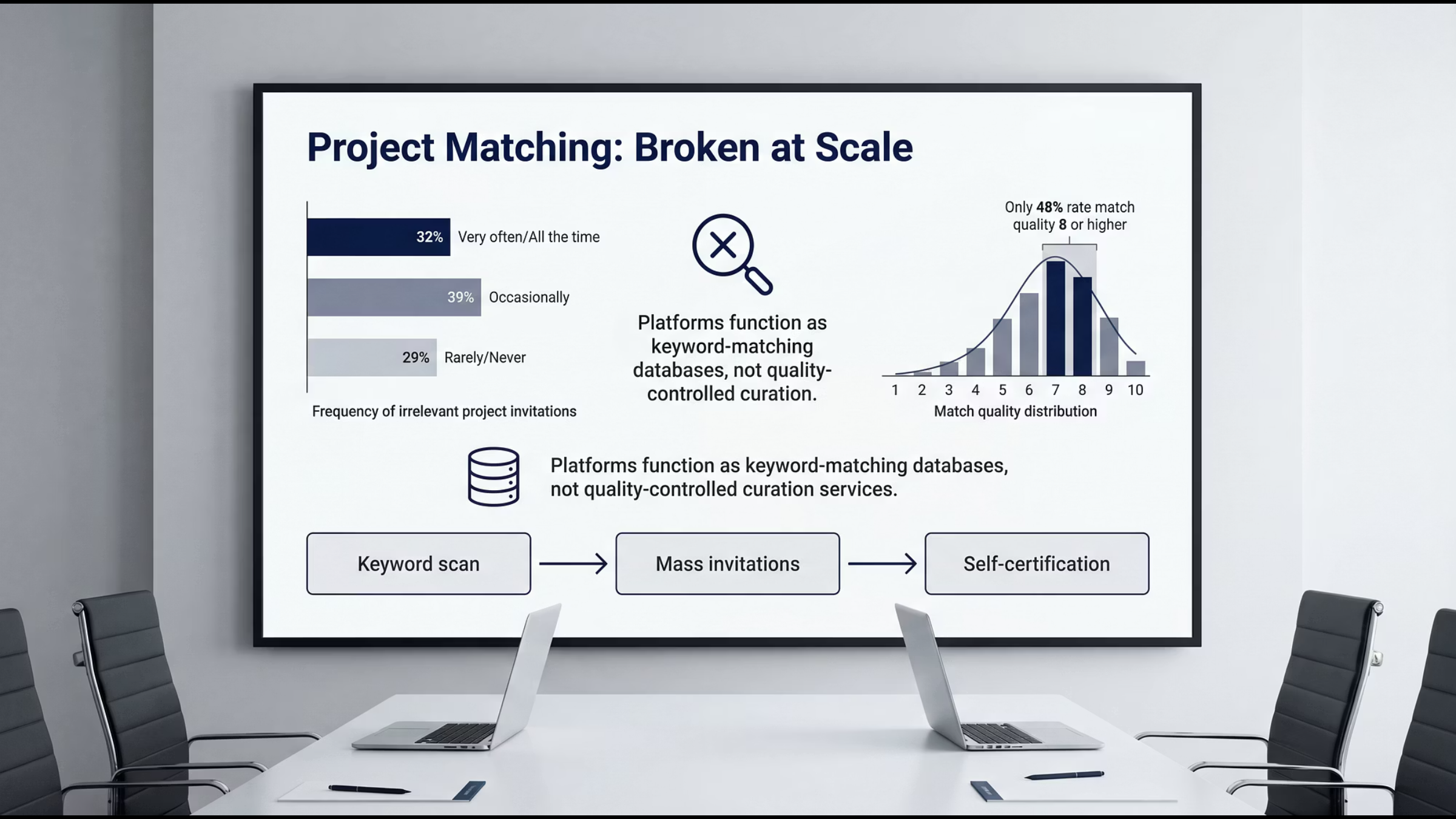

Keyword Matching, Not Quality Control

The research reveals that expert networks function primarily as keyword-matching databases rather than quality-controlled curation services. When asked to rate how well projects match their expertise on a 1-10 scale, experts gave an average score of just 7.5, with only 48% rating match quality 8 or higher.

The mechanism enabling unqualified participants is structural: experts self-certify their own expertise with minimal verification, financial incentives encourage accepting borderline-relevant projects, and platforms lack feedback loops that penalise poor matches. With expert networks under pressure to fill client requests within 24-48 hours, speed takes precedence over precision.

AI Moderation Fails Quality Test

Only 17% of experts have participated in AI-moderated consultations, reflecting limited deployment. Among those who have, 81% reported meaningful deficiencies compared to human moderation, including poor follow-up questions that miss important threads, inability to read context or adapt to conversations, and technical failures including voice recognition errors.

The economics are revealing: whilst platforms replace human moderators with AI, client prices remain unchanged at $1,200+ per call. The cost savings flow to platform margins rather than client value or improved service quality.

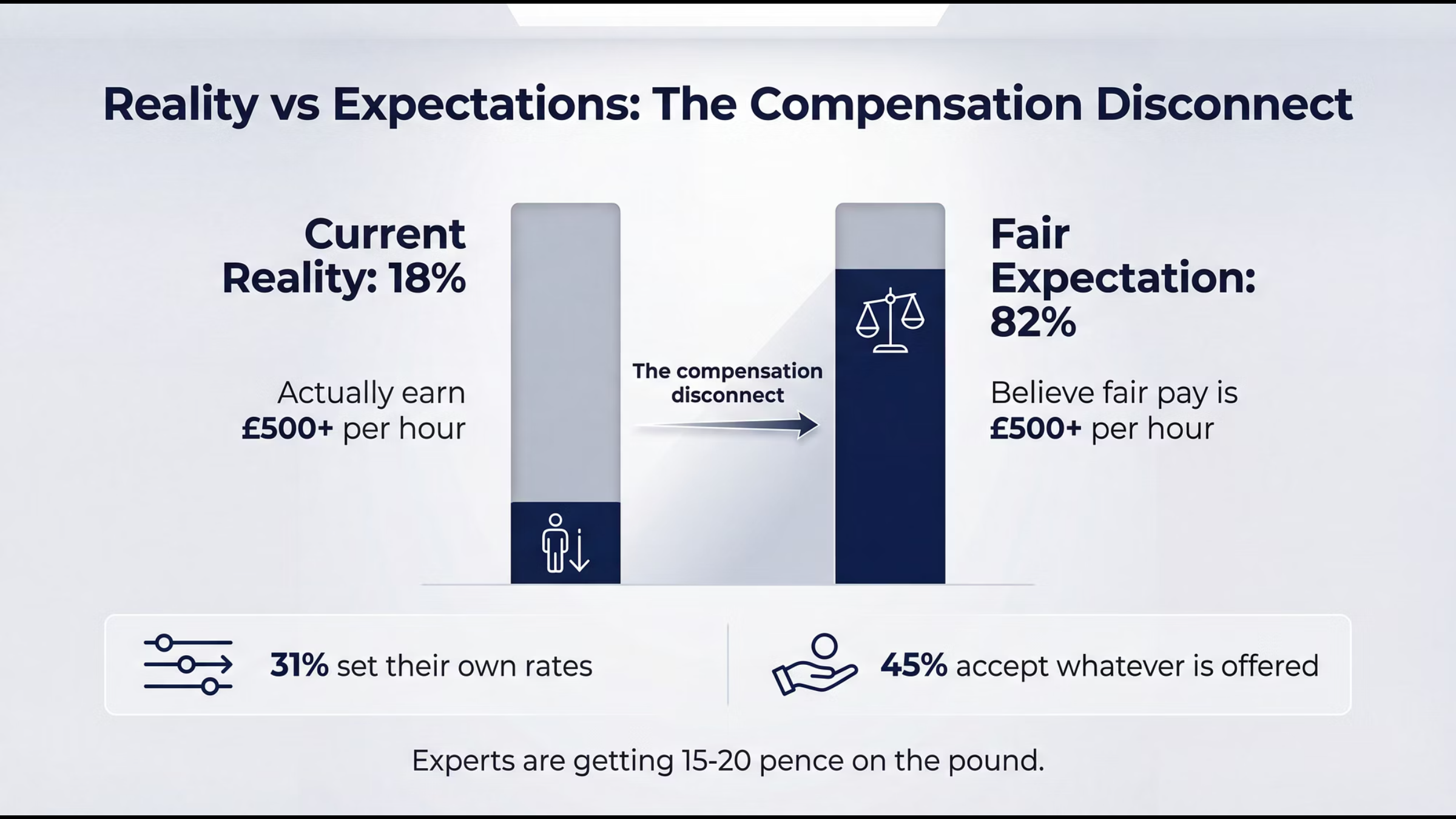

The $1,000 Gap Between Client Fees and Expert Pay

The survey documents a significant compensation disparity. Whilst clients pay $1,000-1,500 per consultation, 65% of experts earn less than $400 per call. The most common pay range is $100-199, reported by 27% of experts.

Only 31% of experts set their own rates. The remaining 69% either have rates set automatically by platforms or simply accept whatever is offered. The gap between expectations and reality is substantial: 82% of experts believe fair compensation should be $500 or more per hour, yet only 18% actually earn at that level.

The difference — often $800-1,000 per consultation — goes to sales teams, account management, compliance operations, technology infrastructure, and platform margins. Expert networks typically operate with 60-80% gross margins.

Implications for Industry Sustainability

The widespread dissatisfaction amongst experts raises questions about long-term market dynamics. When 82% of participants believe they deserve significantly higher compensation, the risk is that the most qualified experts — those with the most valuable knowledge and the most alternative options — exit the market first, leaving platforms with less experienced participants willing to work for lower rates.

The survey found 90% of experts want access to anonymised benchmarks on pay rates, call volume, and platform comparisons, suggesting the information asymmetry that has characterised the industry is beginning to erode.

"The expert network industry is at an inflection point," said Pacitti. "The networks that survive will be the ones that can prove quality, not just promise it. Transparency, verified expertise, and fair compensation aren't nice-to-haves anymore - they're competitive necessities."

About the Research

"The State of the Expert Economy 2025" surveyed 1,368 professionals who participate in expert network consultations across GLG, AlphaSights, Guidepoint, Dialectica, Third Bridge, Tegus, Woozle Research, and other platforms. Respondents were recruited via LinkedIn and direct email between October and November 2025, achieving a 16% response rate. The survey examined compensation, platform usage, project matching quality, AI moderation experiences, and industry preferences.

Download the full report: https://forms.woozleresearch.com/state-of-the-expert-economy

About Woozle Research

Woozle Research delivers verified expert intelligence to investment firms and corporate strategy teams. Unlike traditional expert networks that sell access, Woozle provides finished intelligence with verified expertise, structured outputs, and transparent pricing. Founded by former buyside investors, the company was built on the principle that clients deserve investment-grade research, not databases.

For more information, visit woozleresearch.com.

Media Contact:

Mark Pacitti, CFA

Woozle Research

mark.pacitti@woozleresearch.com